Every CFO has many and varied responsibilities. But running the finances of a private equity portfolio often involves an even broader range of disciplines, challenges and relationships. So what separates private equity CFOs from the rest?

Here are 3 extra complexities of private equity finance – and how to deal with them.

1. Detailed, granular financial reporting

All CFOs are responsible for financial reporting. But the depth and pace of reporting in PE funds can come as a surprise if you’re a CFO new to the sector. For example, a 5-days-or-less monthly close is often a requirement. You’re also likely to have to deal with:

-

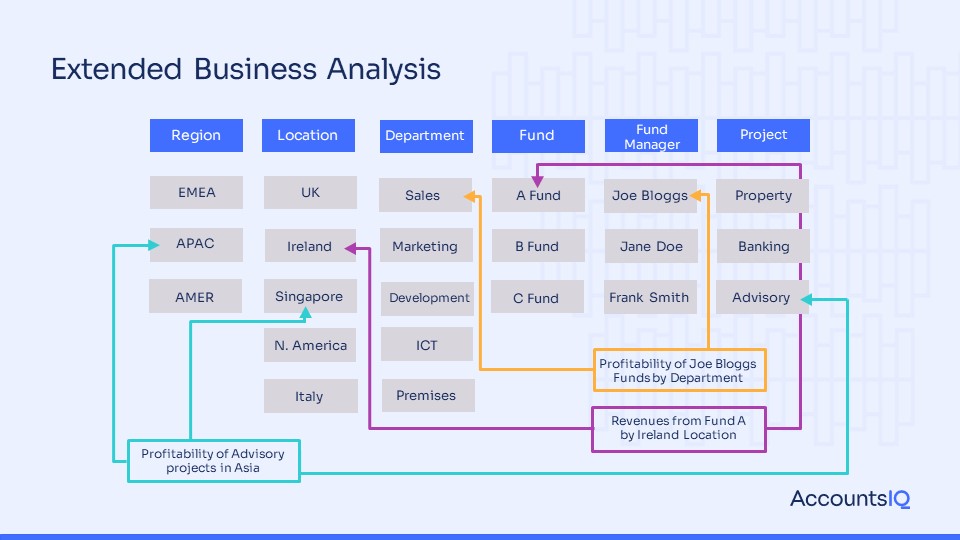

Multi-dimensional reporting and analysis for each SPV/fund

In addition to the monthly close, many PE funds require daily or weekly dashboards showing performance against multiple financial and operational KPIs. Partners or other stakeholders will demand financial visibility and business intelligence to monitor, assess and manage risk across a complex portfolio. They’ll also need to be confident that they’re basing decisions on ‘one version of the truth’ across your portfolio of SPVs.

These reports could take the form of a management pack, dashboard reports or PowerBI reports. Here’s an example of how a private equity firm might set up their multi-dimensional reporting and analysis in AccountsIQ.

-

Consolidated group reporting

As finance chief for a complex portfolio of multiple funds/SPVs you can quickly find yourself drowning in spreadsheets for each entity. When you add in the complexities of inter-company transactions, minority interests and FX re-evaluations, you can easily be spending a week (or more) every month just producing consolidated reports. With AccountsIQ, it’s just one-click to perform your consolidation as often as you need.

“I don’t know of any other system that can do consolidation the way AccountsIQ can. It takes the complexity out of everything and saves us a lot of time. It used to take two weeks to do our accounts; now with AccountsIQ, and other improvements, we get our accounts out in five working days.”

Wayne Copeland, Head of Finance, AES International

Read our AES International case study to find why they chose AccountsIQ to make it easier to consolidate their multiple entities and produce bespoke management reporting packs.

“Previously, Apera’s group consolidation was done in spreadsheets: data was exported from various systems and in different currencies, then brought together in Excel. AccountsIQ’s accounting and consolidation software means there is no fiddling around in spreadsheets trying to get things to tie. Working in Excel was not sustainable; before AccountsIQ, we had instances where we were struggling to get these reports right, sometimes until 2 a.m.”

Rob Shaw, CFO of Apera Asset Management

Read our Apera Asset Management case study to find out why they chose to move from Xero to AccountsIQ when consolidation became too cumbersome and international jurisdiction requirements became too complex.

-

Financial Planning & Analysis (FP&A)

Private equity funds are notorious for their FP&A and financial due diligence requirements. You’re likely to be responsible for providing cash flow projections, financial modelling and forecasting to a greater level of detail than in many non-PE companies. Senior leaders will also look to the finance team to provide industry benchmarking and present insights and scenario plans for multiple growth opportunities.

AccountsIQ facilitates this through its open API structure. We can build custom integrations with your existing business systems. We also have a seamless integration established with financial forecasting software provider, Proforecast, that enables you to bring in data from AccountsIQ to monitor and analyse variations and run multiple ‘what if’ scenario plans.

2. System efficiencies and integrations

Many private equity finance teams are doing huge amounts of manual data processing. They’ll have to revalue every fund in your portfolio each year, taking management fees, overheads and other expenses into account. They’ll also have to handle inter-company transactions, FX, third-party invoices, expenses and multiple, multi-currency bank reconciliations.

This is also a major strain on your attention and resources. We estimate that at least 90% of these manual SPV accounting tasks can be automated. Here are just a few examples:

- OCR (Optical Character Recognition) technology can digitise invoice processing

- Approvals can be automated, tiered and securely stored on central platform rather than scattered across multiple email inboxes

- Expenses can be uploaded and approved on a mobile app

- Open Banking enables automated bank reconciliations.

“Everything from the VAT to the reporting, has been really quick and easy to implement. The accruals and pre-payment functions and bank uploads all work exceptionally well and save a lot of time. It’s fantastic. The whole team uses the expenses app; they like that they can sit in a restaurant and just take a photo of the bill, upload it and it’s done. AccountsIQ is perfect for the high complexity, low transaction nature of Private Equity accounting.”

Jeremy Paul, CFO, Queen’s Park Equity

Read our Queen's Park Equity case study to find why they chose AccountsIQ to monitor and control the inter-company transactions of their FCA-regulated UK advisory entity and service company.

3. Driving change

PE firms are fast changing, high growth environments; they’re generally not in business to stand still or operate in ‘business as usual’ mode. Acquisitions, mergers and new investments, capital restructurings, changes in personnel, the use of external consultants and surge resources are just a few examples of the constant changes CFOs can expect as part of daily life. As a result, you – and your team – will be expected to adapt to revised budgets, forecasts, financial models and structures.

Installing a Cloud accounting platform, such as AccountsIQ, where each SPV is set up as a separate entity gives you the flexibility to expand at pace. This structure means you can add new SPVs to your finance system in minutes. You’re able to incorporate them into the everyday day running of your business straightaway; you don’t need to configure anything.

Find out more about the unique accounting challenges facing private equity CFOs

Register for our new Consolidation and Multi-Entity Accounting for private equity firms webinar on Wednesday, 22 February 11:00AM.

In just 30 minutes we’ll show you how AccountsIQ can help you manage your multi-entity and SPV accounting and reporting needs, including how to:

- Automate consolidation of your SPVs/other entities in one click

- Recharge costs to your investments and entities

- Ditch your spreadsheets and have all the data you need in one easy to use system

- Provide the management report packs that give you all the insights you need.

Join us and discover why Marlborough Funds, Apera Asset Management, Salamanca Group, Intriva and Queen's Park Equity all use AccountsIQ.

Can’t make 22 February? Register anyway and we’ll send you the webinar recording.