Private Equity & Venture Capital Accounting Software

-

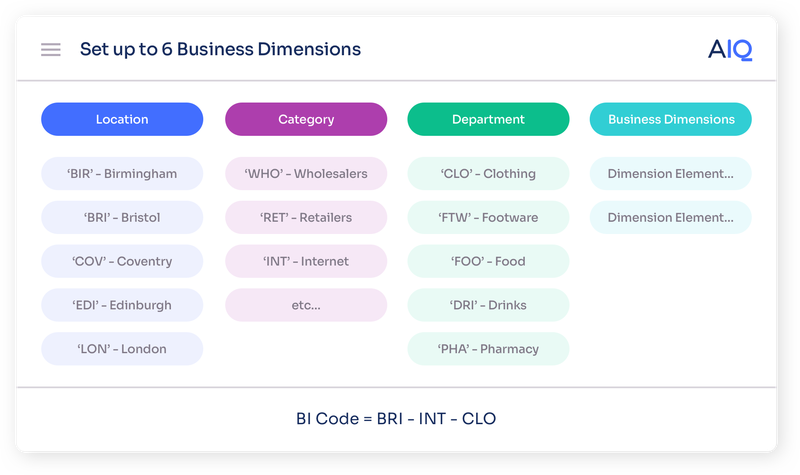

Modern accountingSimplified yet comprehensive accounting to monitor fund positions and activity.

-

Group reportingContinuous consolidation of portfolio entities including minority interests and FX.

-

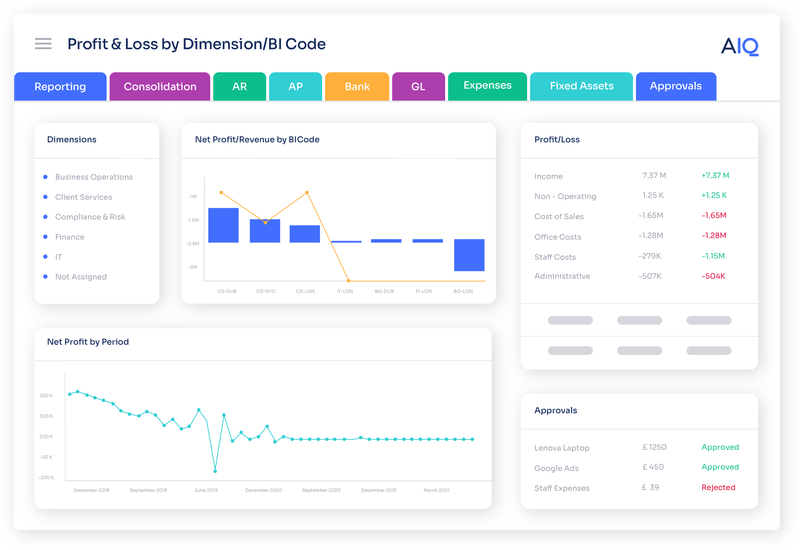

Role-based dashboardsProvide stakeholders with visibility for better, more informed decision-making.

-

Integrated reportsA library of standard reports give consistent views of portfolio for comparisons.

The ideal solution for management accounting

The continuous consolidation engine at the heart of AccountsIQ allows you to keep track of all your investee companies in near real-time. AccountsIQ is perfectly matched private equity accounting software for a portfolio of early seed and growing companies.

Start your start-ups as you mean to go on

With a diverse portfolio of investee entities you might find you have to cope with multiple accounting systems designed for either startups or enterprise organisations. AccountsIQ is your single platform helping your investee companies account from start-up through scale-up to maturity. Get all your entities, including SPVs and JVs, onto the right accounting platform, right from the start.

Download our private equity accounting software brochure

Consistent portfolio monitoring

The AccountsIQ platform provides a common set of reports, dashboards, enquiries and OData connectors. Your portfolio can be monitored using our library of reports and dashboards. Each entity may operate unique chart of accounts but our consistent and regular summaries keep you fully in the picture.

Trusted by these Private Equity firms

Keep control when and where you need it

Managing a portfolio at different stages of growth can have its challenges especially when you find out after the event that monies have been spent that shouldn't have been. Our collaboration tools allow you to play an active part in the entities that need your support. Our workflow-based approvals of purchase orders, invoices, payment runs and expense claims ensure you are involved in the big decisions.

Giving your company the edge

-

Consolidate your portfolio

Our consolidation module underpins the portfolio and fund management capabilities at the heart of AccountsIQ. -

One platform

One system with common structures makes comparative reporting more accurate and efficient. -

User profiling

Strong access controls allow secure access to specific functions and reports. Confidence in governance systems is inbuilt. -

Audit trail and log

By tracking all logins and transaction activity you can review who is doing what around your portfolio. -

Collaboration

The key to growth in any organisation is working closely with your investee companies, SPVs and JVs. Provide real-time advice and support as needed. -

Reporting

An extensive range of available reports is complemented with dashboards, our Excel add-in and OData links to Power BI -

Dashboards

Our library of visualisations is ready to deploy at portfolio level as well as within entities. The interactivity deployed allows significant flexibility in how to use the information shared. -

Switch, upgrade, migrate

The unique power of AccountsIQ's scalable accounting software enables rationalisation of the accounting software used across your portfolio. From start-up, through scale-up to maturity. -

Integration

Our flexible integration options including a powerful API suits the majority of business sectors. Funds can deploy AccountsIQ as widely as possible to maximum effect.

Top 5 benefits of adopting AccountsIQ to manage a growing portfolio.

Customers see success with AccountsIQ

See all case studies-

AES International

AES were delighted to find a solution that is intuitive to use and enables them to report their group structure …Find out more -

Salamanca Group

Merchant banking business Salamanca Group comprises approximately 80 businesses. Switching from Sage 50 to AccountsIQ means consolidated management reports can …Find out more -

Apera Asset Management

Apera Asset Management chose to move from Xero to AccountsIQ when consolidation became too cumbersome.Find out more -

Dentex Replaces Xero with AccountsIQ and Kefron AP to Reclaim 30% Admin Time

Fast-emerging dental corporate, Dentex, has acquired 150 practices since its beginnings in 2016. Switching from Xero to AccountsIQ has allowed …Find out more

Keep control when and where you need it - see the power of AccountsIQ

Request a demo