It goes without saying that the last few weeks have been challenging for everyone both inside and outside of work. At AccountsIQ, we’re fortunate that our own move to remote working was fairly painless. So our team have been kept busy continuing to build and support our Cloud accounting platform, so your finance team can continue to operate and produce your numbers with minimal disruption.

Here’s a summary of the latest product changes released in the last few weeks and also news of what’s currently in the works and in our release plan.

Reporting

We’ve made some new reports available which have been high on the wish list of many of our clients:

Supplier (Vendor) Bank Account Details Audit Report

This report presents a full audit trail of all changes made by users to the supplier (vendor) account bank accounts. It can be used as a historical record to verify any such changes made for assurance purposes. Changes are listed in descending sequence, showing the latest changes first.

The report can be found in the new ‘Assurance’ section within the Report Manager.

Note that this report has been enabled by default only for Global Admin User profiles. Should you require it and don’t see it within your current set of reports, please contact the designated Admin user within your organisation or contact your local support team.

Purchase Commitment by Approver [Use with Budget Holder Approval Only]

This report provides a breakdown of committed expenses versus budget or revised budget by approver (budget holder).

For the selected approver, it provides a detailed breakdown of expenses by BI Codes and by GL accounts. It also provides with the breakdown of transactions making up the actual expenditure along with the breakdown of transactions making up the committed expenditures.

Committed expenditures include purchase orders which are approved but not yet delivered, orders that are delivered and not yet invoiced, and invoices that are not posted to the general ledgers.

This helps approvers and those managing expenditures ascertain if they are over or under budget for a particular budget holder by comparing to the budgeted figures.

Note that entities need to have budget holder approval functionality switched on to use this report.

This report has been enabled by default only for Global Admin users only by default.

Bank Payment/Receipt Reprint

This report allows users to print receipt or payment documents related to Bank Receipts and Bank Payments from the Report Manager (Cash & Bank Reports section).

This report has been enabled by default only for Global Admin users only by default.

Sales Orders & Invoices Listing Extract

This extract report displays a list of Sales Orders or Sales Invoices that can be filtered in multiple ways and is suitable for extraction to Excel for further analysis.

Outstanding Sales Orders and Invoices

This report provides a list of orders that are not delivered yet, orders that are delivered but not invoiced, and invoices that are not posted to the general ledgers for customers.

Introducing Group VAT Reporting in AccountsIQ

The AccountsIQ platform is used by thousands of companies who already submit their MTD VAT return digitally to HMRC.

New functionality is now in place which allows a consolidated group VAT return to be submitted digitally to HMRC under MTD.

AccountsIQ’s solution is best practice solution for group companies needing to submit a group VAT return, as using the AccountsIQ platform the process will be efficient, reduce inaccuracies and the underlying architecture will provide the ability to produce a ‘detailed VAT return’ report. Essentially this is what HMRC ask for ahead of an enquiry, something that is not so easily achieved using multiple spreadsheets, digital links and APIs.

To find out more about how your Group can submit its MTD VAT return read our How to Guide on Group VAT submissions.

Introducing Two Factor Authentication in AccountsIQ

The security of your financial data is of paramount important to us. One of the easiest and most effective ways that you can protect your account is to use Two-Factor Authentication (2FA), which now comes as a standard (optional) feature in AccountsIQ.

Using Two-factor authentication means that after entering your login name and password to access the finance system, you will also need to enter a code generated from your linked mobile app to log on.

Verification codes are unique to you, they are generated by a (free) app on your mobile device (such as Microsoft or Google Authenticator) and each code can be used only once. Most apps can generate verification codes even when your device has no phone or data connectivity.

Note that the authentication mobile apps we recommend don’t rely on sending SMS messages with codes or require you to register your mobile number with AccountsIQ.

You will also be issued with a set of one-time use back up codes that you can print or download for use if your phone is unavailable, so that even if you forget your phone you still have a way of logging in with those backup codes.

The key takeaway is that no one else can log into your account as you are the only person who knows your login name, password and has access to your authentication mobile device.

- If you login to different companies using a group login, you only need to set 2FA up once and it will apply to all companies within the group.

- If you have more than one login name and/or login to multiple companies you can set up separate 2FA accounts using the same app.

- If you always use the same computer and browser to login to the finance system, then you can choose to enter the code once every 30 days rather than each time you log in.

Sounds good? Then please read our How To Guide on 2FA and then switch it on for your account – it only takes a few minutes.

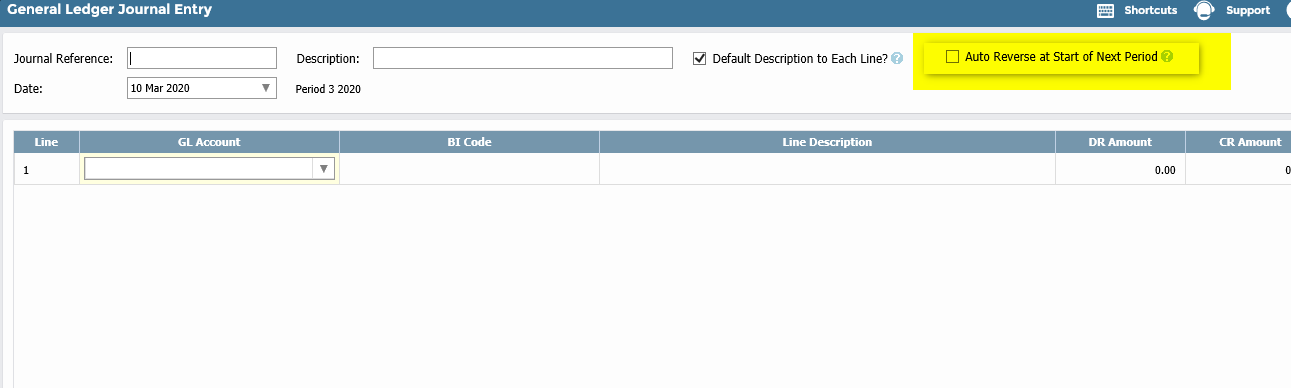

Auto Reverse Option Now Added to General Ledger Journals

We’ve added a new check box to the header of the General Journal screen. You can click this if you want the journal to auto reverse at the start date of the next period. This is a simple alternative to make a reversing journal as opposed to using the existing Accrual journal functionality or for any other types of journals that require auto reversal.

API – Single API Method to Post Invoice, Payment & Allocate in one go!

We’ve created a new API method to support common scenarios that many third party applications require when integrating sales data with AccountsIQ.

For example, an online e-shop or EPOS will often want to record a customer invoice and receipt simultaneously and allocate the two together at the same time from an accounting point of view. This enables the efficient implementation of the following set of operations when building integrations:

- For a given customer, verify that there are no existing invoices with the same reference number (ie ‘external reference’ or ‘Ext Ref’ in AccountsIQ). This is a step used to prevent duplicate invoices from being created.

- Verify that there are no sales receipts with a given receipt reference already existing in the system.

- Post a sales batch invoice to the Sales Ledger (AR).

- Post a sales receipt for the full or partial amount of money of the invoice to the Sales Ledger (AR).

- Allocate the receipt to the invoice for accounting purposes

This API Method will eliminate the need to call multiple (separate) API methods to achieve the same result thus saving coding time and improving the throughput of transactions via the AccountsIQ API.

Mobile Expense & Approval App Enhancements – Push Notifications & More!

We’ve just released a bunch of new enhancements to our mobile app covering both employee expense capture and approval of purchases. You will need to download the latest version of the AccountsIQ mobile app from the Apple AppStore & Google Play to obtain these enhancements.

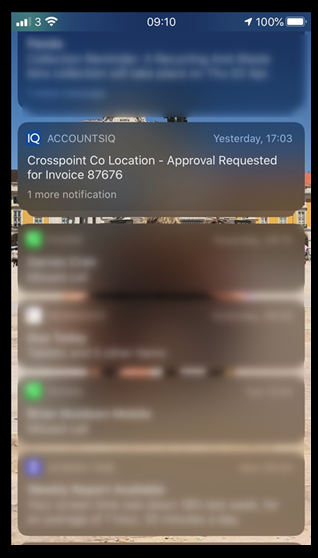

Push Notifications

Push notifications are now live for both expenses and approval. You can now receive a handy notification on your device when there is something to approve or else to notify you when your expense claim has been approved (or rejected).

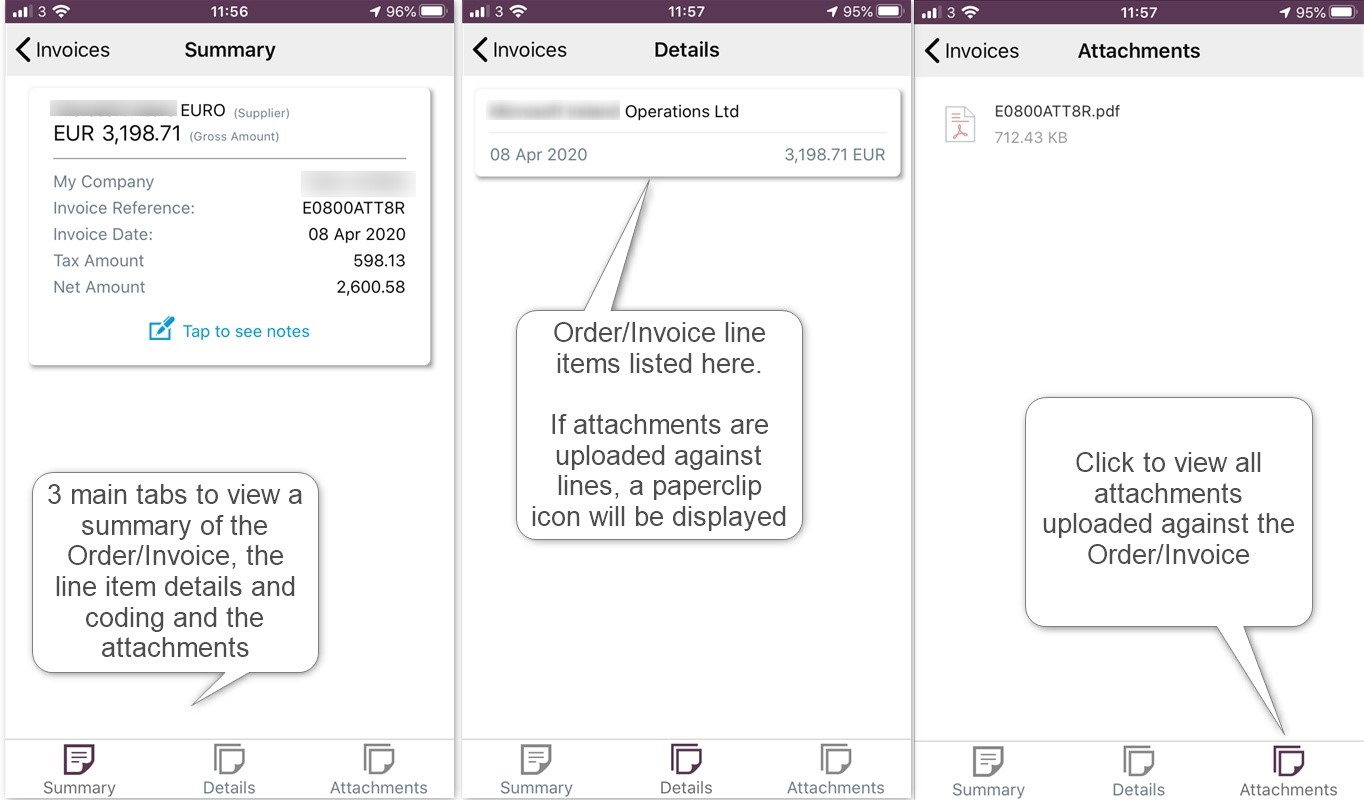

Approval App Layout Improvements

We’ve made some extensive changes to the Approval app layout to aid navigation and reviewing of Orders & Invoices as part of the approval process:

Editing Expense Claims

Editing expense claims previously resulted in a resubmission of the claim for approval each time it was updated by an employee.

We’ve now released a change so that once an edit to a previously submitted claim is made, the claim is set to a pending status and the employee can decide when to re-submit the claim for approval thus triggering one approval request to be made.

Other Changes & Fixes Released

API

The GetTransactionChangesBetween API was only returning changes for sales/purchases ledger transactions, but not for Gl ledger transactions, this is now corrected.

BI Code Capture

We’ve recently made a change to the Batch Sales/Purchases Invoices & Notes screens so that they save the BI Code of the last line entered of a transaction on the control line posting. The is done for reporting purposes so that the BI coding is properly captured for the control account.

Note that this change is not retrospective and will not fix previous data that was posted without the BI code against the control line.

What’s coming next

Here’s a sneak preview of the next set of major feature releases in 2020:

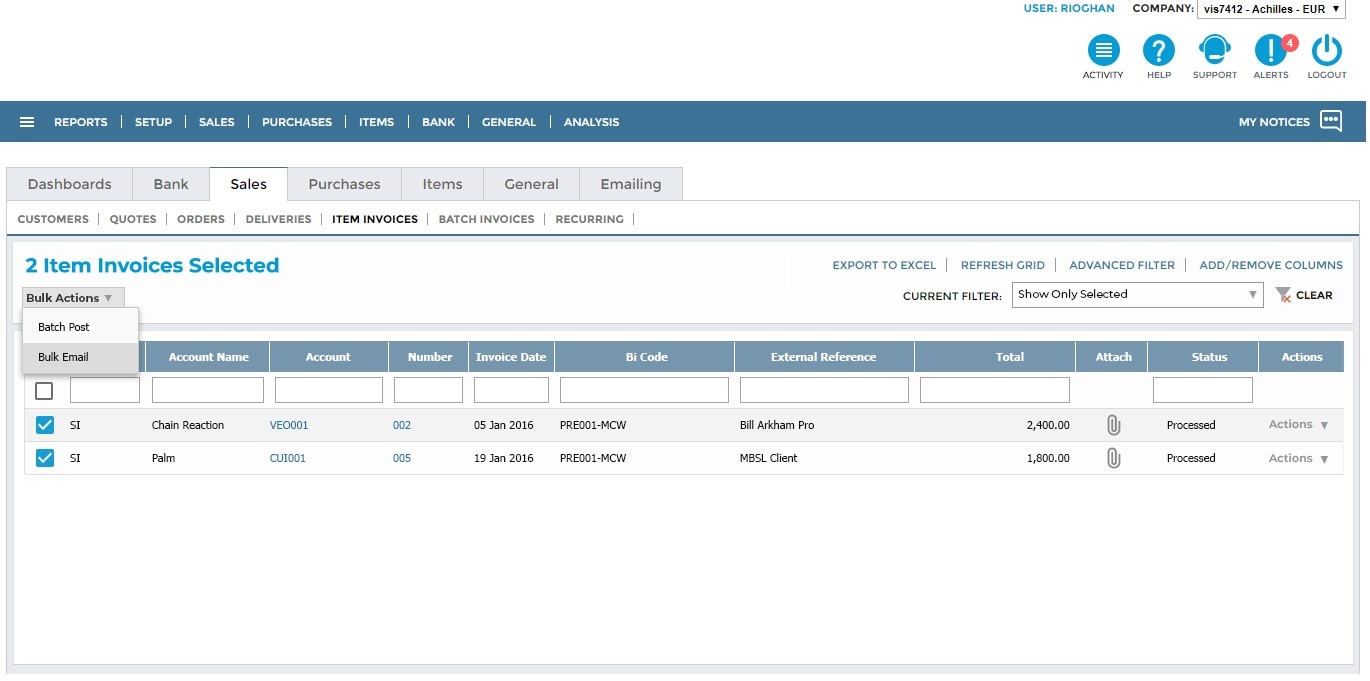

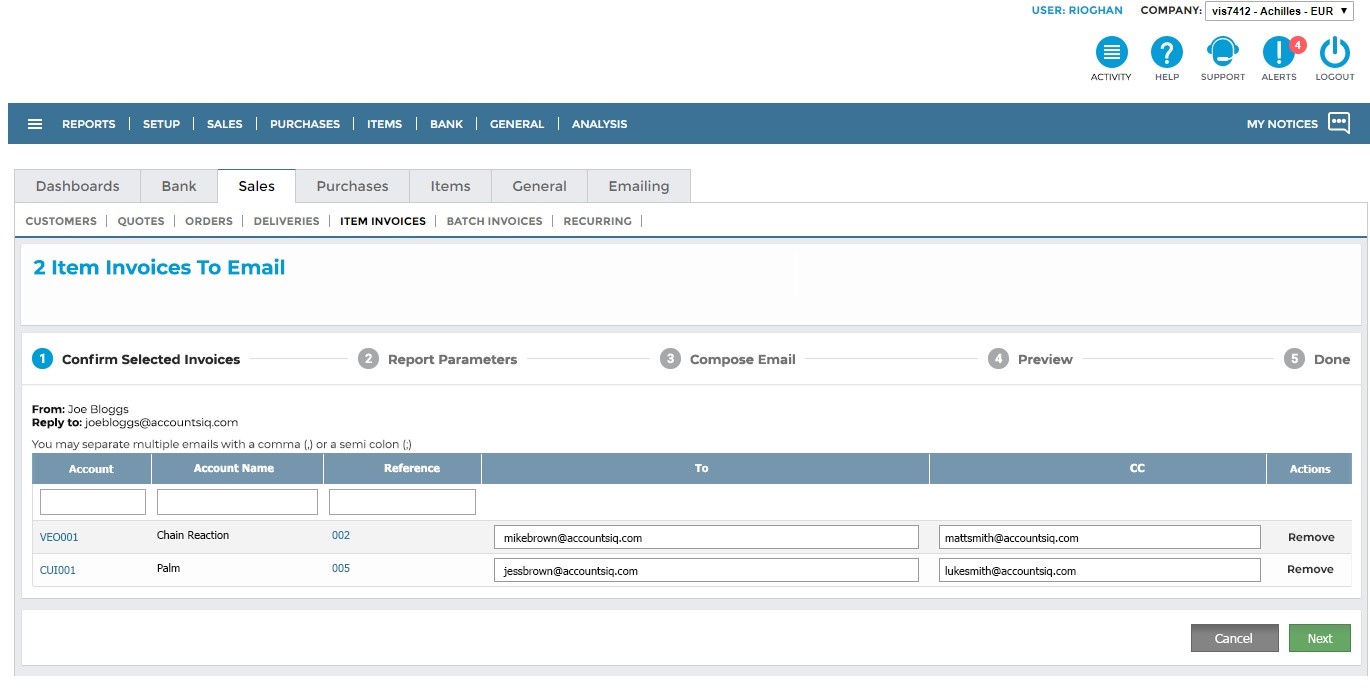

Bulk Email Batch Actions

We’re in the final stages of developing our upgrade of the Bulk Email function in the system. The screenshots below illustrate the look and feel of this new functionality which will be baked into all the relevant listing grids such as customer, suppliers and invoices.

It will improve the speed involved in selecting records and generating bulk emails, along with providing greater traceability in terms of whether the emails were delivered successfully. We’ll be introducing this functionality with our beta clients in early May. If you would like to sign up to the beta program please contact your local support team.

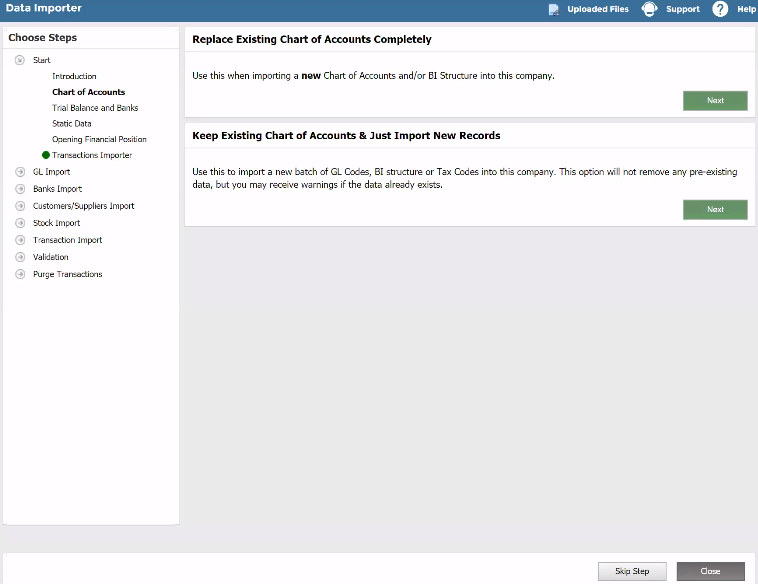

Onboarding Tools

Since last year we’ve been redeveloping the tools used to onboard data into AccountsIQ. We’ve started with the Chart of Accounts set up process, and have developed a completely new Excel based template that will manage import GL Accounts and BI & Dimension data into the system.

There are now two clearly separated user journeys for replacing a Chart of Accounts entirely or just importing new records into an existing Chart of Accounts.

It’s really easy to use and speeds up company setup massively. We expect this to be released globally in May.

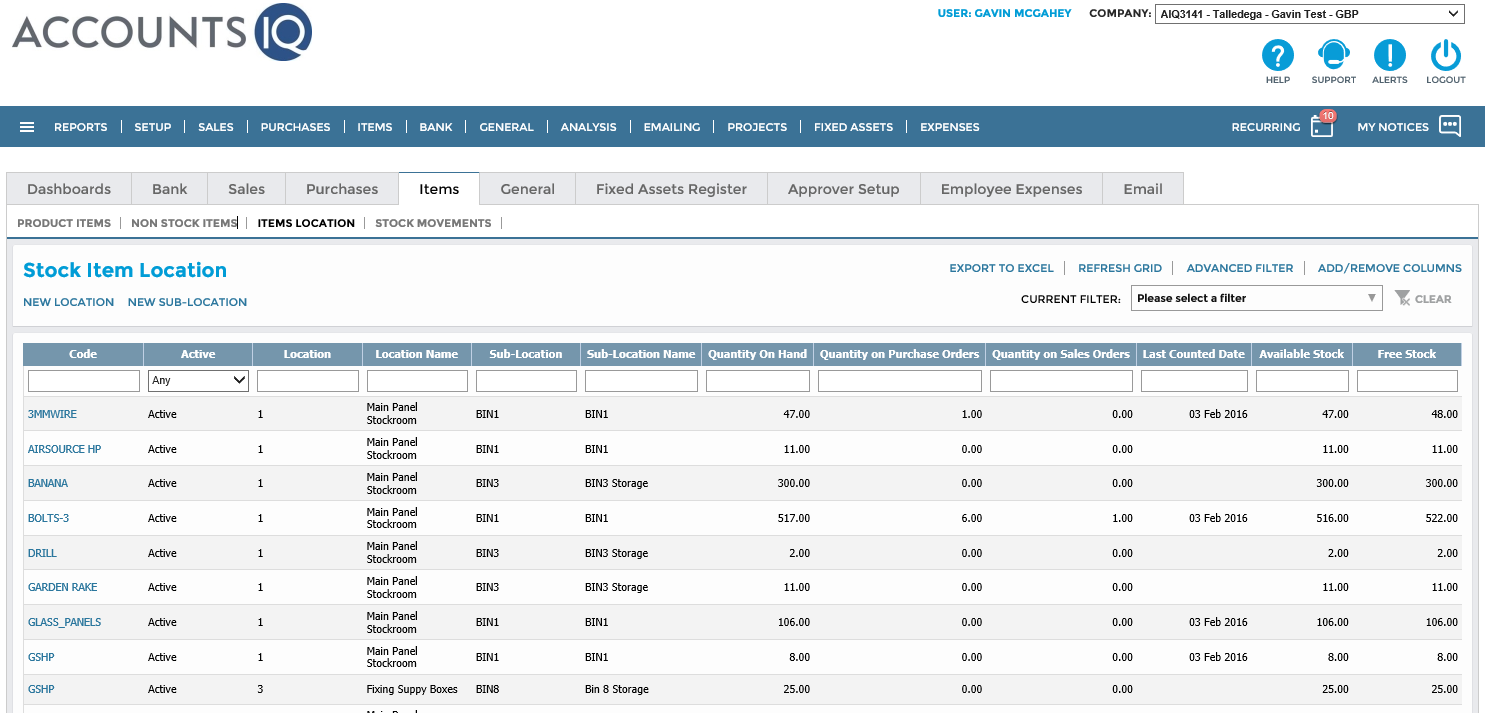

Item Management

We’ve been working on making the maintenance of Product (Stock) Items easier in the system as part of our complete upgrade of Item Maintenance, part of which is making the function work on Chrome as well as Internet Explorer.

The first release of this will include two new grids, the first of which provides a listing of Item information by stock location:

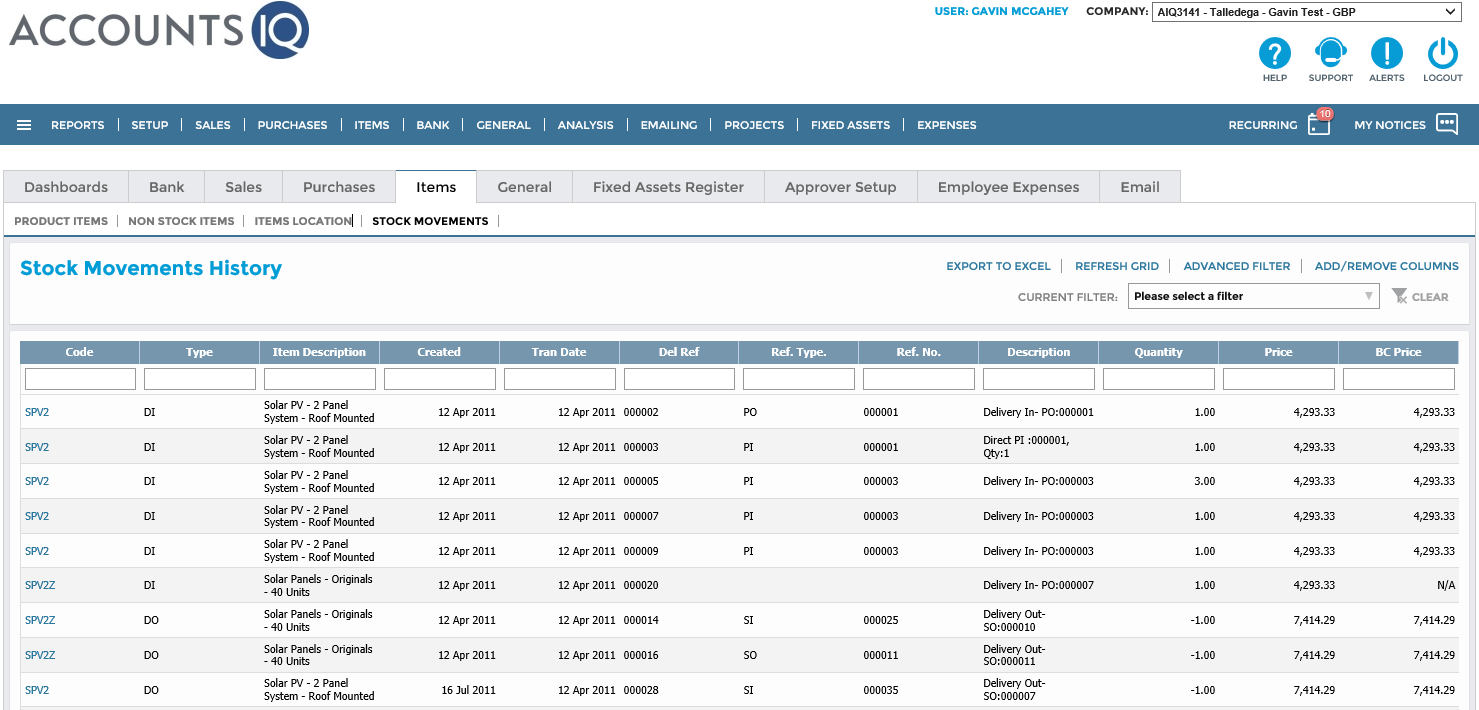

The second grid displays all Stock Movements in an easily searchable listing:

Testing is almost complete on these grids and they will be released globally before the end of April. The next phase of this project will be the redevelopment of the Item Maintenance screens (Stock and Non Stock Items), and making them work in Chrome.

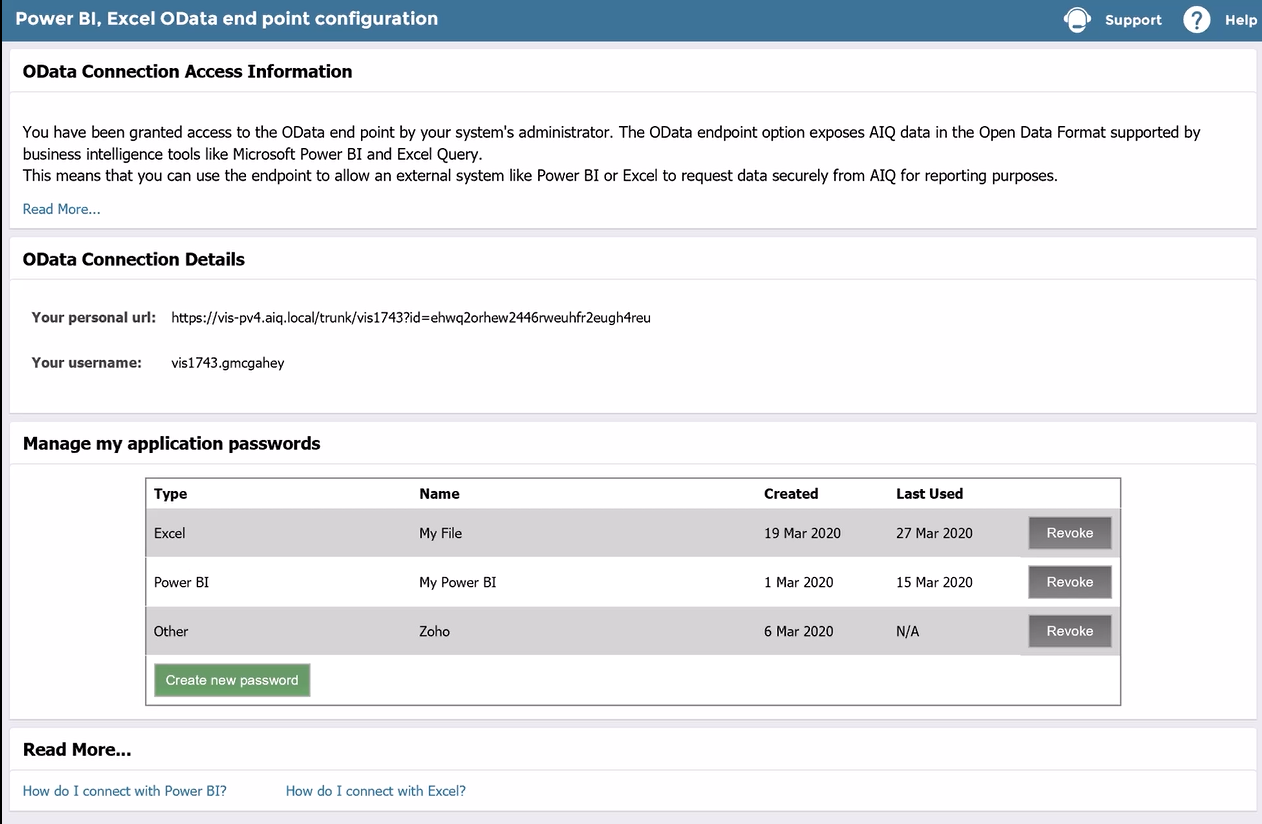

PowerBI & Excel OData Connector for Extracting Reporting Data

We are currently working on a PowerBI & Excel OData connector. This will provide users with access to a URL which they can link to within PowerBI (or Excel) to securely extract reporting data from AIQ. The OData Connection set up screen is shown below:

Once the data is downloaded into PowerBI (or Excel) it would be available to report on using those tools natively.

Eventually, our plan is to provide content packs with pre-formatted Management Accounts style report packs which users will be able to adapt for their own needs. Our current plan is to release this to beta clients at the start of June.

And Finally….

We’re working with an FCA approved Open Banking Partner, Plaid that will facilitate integration with Banking feeds from the main UK & Irish high street banks. That means bank statement data will be imported securely and seamlessly into AccountsIQ for reconciliation, removing the need for users to extract statement files from their banks and import them. We’ll have some official news on this partnership in the coming weeks.

Last but not least…our Product Design team is currently working on redesigning our Supplier Batch Payments function. This redesign will introduce a simple stepper-based flow for making supplier batch payments through the product, and will also work fully in Chrome.