Renewable energy could power the world by 2050. That could save millions of lives from air pollution, reverse the effects of climate change and secure our energy supply. This means that finance managers in the renewables sector face all the challenges and complexities of a surging industry; raising funds, managing growth and maximising the returns of multiple assets.

AccountsIQ’s award-winning Cloud accounting software has rapidly become the financial management platform of choice for renewable energy companies who need to:

- Track costs against individual renewable assets while under construction

- Manage multiple renewable assets (usually via SPVs) once operational

- Spread costs across multi-site operations with a dispersed workforce

- Handle multi-currency transactions for assets in multiple jurisdictions

- Consolidate group-wide results allowing multi-dimensional reporting

Five ways AccountsIQ can help renewable energy companies power their growth:

1) Automate and streamline finance workflows

The manual data entry and processes involved in managing multiple SPVs can be huge and gets more complex as the number of SPVs grow. But processes like raising purchase orders, approving invoices, allocating costs to each asset, handling inter-company/SPV recharges are all tasks that can be automated. In fact, we estimate that up to 90% of manual SPV accounting tasks are ripe for automation.

Justin Ampofo, Finance Manager with global renewable energy provider BayWa r.e, estimates that implementing AccountsIQ has freed up over 20% of his finance team’s time. That’s mainly due to automating key processes, such as expenses and approvals. Automation has also enabled them to go paperless, while maintaining full traceability and reduced human input errors.

AccountsIQ also simplifies multi-currency accounting and inter-company recharging. Global geoscience and consultancy group Getech used to manage their Sterling and US dollar accounting in Excel. Now, with AccountsIQ, the exchange rates are held centrally in the system, with all subsidiaries using common exchange rates and the system automatically handles realised and unrealised gains/losses.

Getech’s Financial Controller, Simon Brown explains:

“AccountsIQ’s currency revaluation feature creates an automatic routine in the system which ensures accuracy in the calculations and reporting. The other aspect of our internal process that has greatly improved since we have implemented AccountsIQ is the inter-company invoicing. AccountsIQ keeps track of what we are invoicing internally; when the invoice is received it registers automatically in the subsidiary accounts.”

2) Access your finance system from anywhere

Although renewable assets are at a fixed location, your staff are not. AccountsIQ is a Cloud financial management system. This means your team can have complete anytime/anywhere access to real-time financial data. They can work from home or any of your sites and you won’t need expensive, high-maintenance servers in each location. Approval of POs and invoices can be via mobile app and all documents relating to accounts or transactions are stored in AccountsIQ accessible at the touch of a button.

3) Multi-entity consolidation

Renewable energy businesses are rarely single entity and often cross into multiple jurisdictions. AccountsIQ enables consolidation of multiple entities in multiple currencies in just one-click. This gives renewable energy finance teams full visibility of group-wide results, including their currency exposure, without the need for complex Excel models to consolidate results. Getech’s Financial Controller Simon Brown says:

“AccountsIQ saves me a week’s worth of work every month end.”

Consolidated reporting is an absolute must for any CFO managing multiple SPVs. Going off-system to manipulate data in Excel gets more difficult as the number of SPVs grow. One-click consolidation of actuals and budgets/forecasts, with proper handling of inter-company balances, accurate FX re-evaluations and multi-dimensional reporting in group currency is a major time-saver.

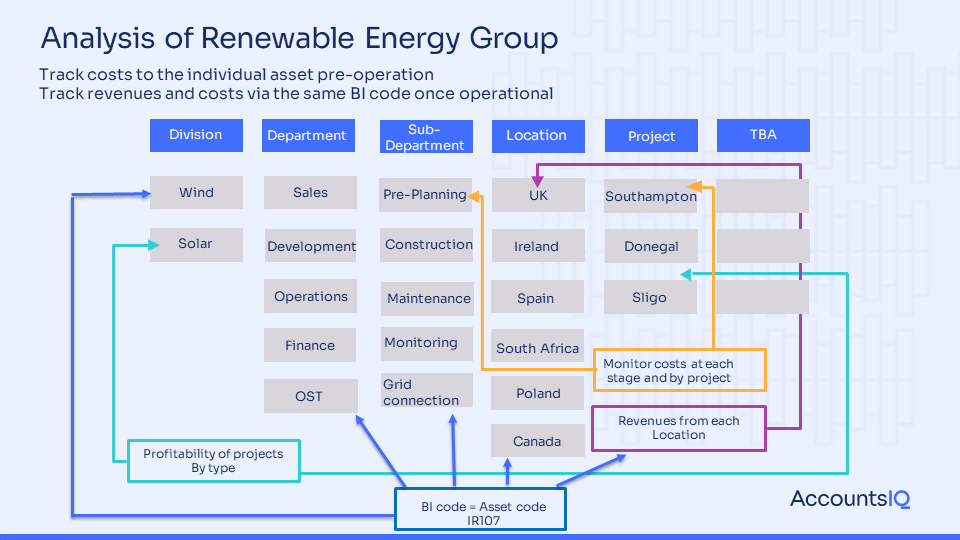

4) Multi-dimensional reporting across any number of SPVs

The advantages of controlling renewable assets via SPV are significant but that doesn’t need to come with the disadvantage of having information spread across individual companies. With AccountsIQ, your team can securely view the results of all your SPVs in real-time, on one platform. Finance Directors can see real-time consolidated results in base currency for all SPVs across multiple jurisdictions. Fincovi provides commercial asset management services to clients in the renewable energy industry and according to their CEO, Ray O’ Neill:

“We adopted AccountsIQ’s financial management software because the key to successful commercial asset management is the ability to see KPIs at a glance across the whole portfolio.”

AccountsIQ give you the flexibility to design and build your reports with almost no restrictions on what, when or how you report. When you have less ‘noise’ in your finance system, you get much better visibility of financial performance. This makes it easier for finance directors to monitor performance, assess opportunities and manage risk across a complex portfolio of SPVs and assets.

Simon Brown of Getech believes:

“The biggest benefit that we see with AccountsIQ is that the data is dynamic; it is not just a report. We can drill down into the data, solve the query, and re-run the report accurately. We simply update or correct as necessary.”

5) Adding new SPVs or other entities is quick and easy

Renewable energy assets take time and considerable cost to build. Tracking the cost of the asset before it becomes operational is vital. AccountsIQ’s BI structure allows costs to be tracked easily to individual assets. This can be setup in an SPV from day one or transferred to an SPV once it is completed and ready to become operational. In AccountsIQ you can set up any number of new BI codes and SPVs/subsidiaries in minutes with the BI tracking all the way from the build cost to the operational performance. That’s important in a fast-growth sector like renewables. As Simon Brown of Getech explains:

“The initial design of the subsidiary system becomes the template for new businesses within the group. The process for expanding AccountsIQ is simple, requiring only additional licences and the roll-out of the core system as it has already been modelled for Getech companies.”

Watch our webinar recording: Multicompany SPV Accounting Consolidation Webinar.

Find out more about AccountsIQ’s Renewable Energy Accounting Software.