Cash Flow Forecasting Software

-

Modern accountingUse the transactions you've posted to guide your understanding of cash.

-

Group reportingSpot cash trends around your group in good time to take effective action.

-

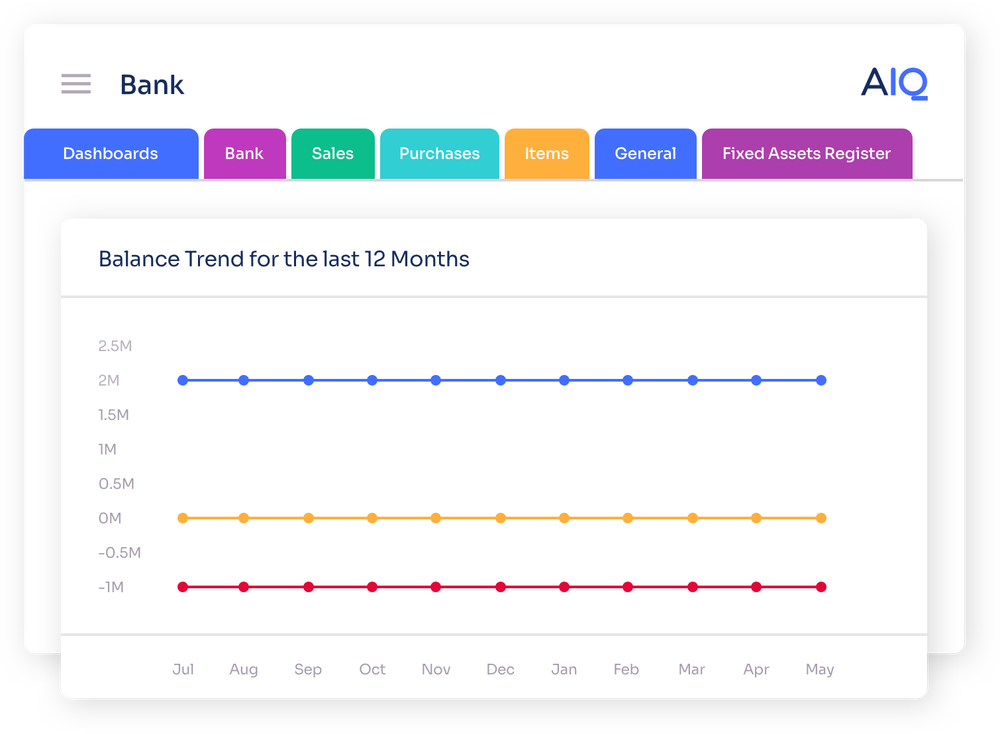

Role-based dashboardsA visual forecast chart helps provide understanding alongside the data.

-

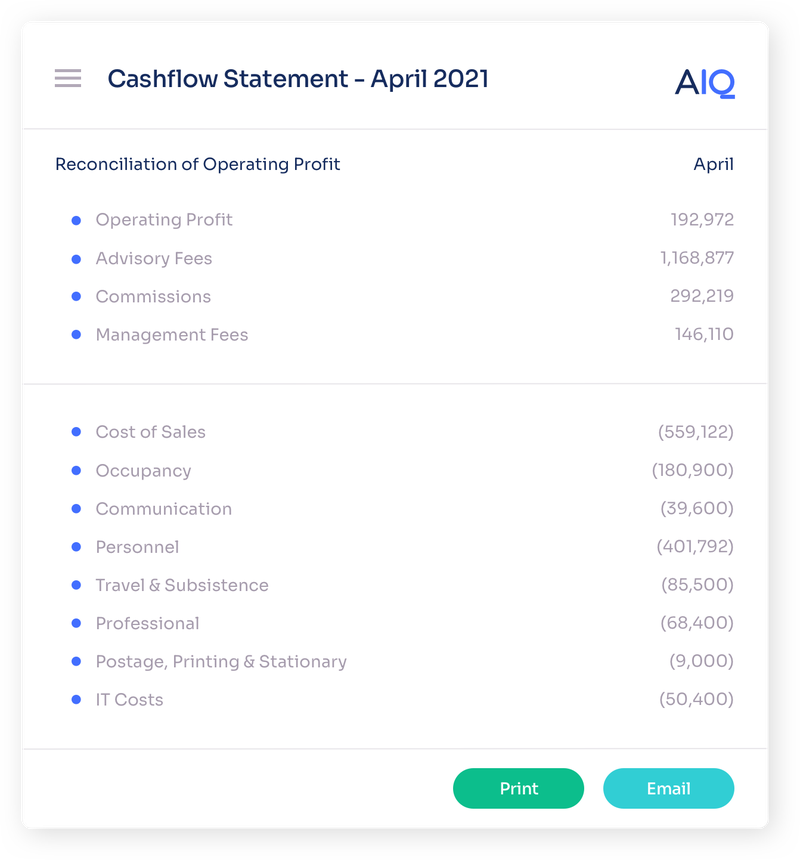

Integrated reportsExport the forecast to Excel for further modelling or print to share.

Prevent unexpected cashflow problems with effective cash flow forecasting

One of the primary reasons for businesses getting into difficulty is failure to spot cash flow problems in good time. AccountsIQ allows you to maintain a range of forecasting models covering short term and long term time periods. The models allow you to filter transactions and edit dates to adjust the effect on cash of anticipated P&L budgets and asset liquidation.

Manage future cash requirements

Using the short term debtor and creditor transactions posted within AccountsIQ as well as budgeted P&L and accrued tax liabilities you'll be able to make early decisions about strategies such as additional funding, overdrafts or invoice discounting type credit. Combining actual transactions with planned activities from AccountsIQ P&L budgeting provides you with the tools you need to look forward with confidence.

Include cash flow forecasting in your monthly management reporting

AccountsIQ focuses on delivering online capabilities that speed up your accounting cycle and reducing the time taken to close your period reporting window. Spend less time gathering data and more time analysing both within Finance and out in the management teams around the organisation. Growing businesses can use AccountsIQ to provide enterprise-grade functionality within our affordable subscription plans.

-

Online forecastingAll the details you need available at your fingertips. No need to search and collate, it's all here.

-

Customise time periodsShort term operational cash management or longer term strategic planning. Customise your scenario models.

-

Monitor bad debtsIdentify serial late payers who damage cash flow and take action to restrict their credit, thus preserving your cash flow.

-

Evaluate subsidiary performanceGrowing businesses can start to act like a Group Treasury function by modelling all subsidiaries.

-

Choose accounts to includeDefine the accounts that are critical for your forecast model. AccountsIQ will include certain transactions automatically.

-

Preserve edits in modelEdit the modelled scenario to change expected dates of cash events and preserve these edits through further forecast runs.

-

Choose bank accountsFocus on the trading bank accounts that have the most transactional activity to ensure you have full visibility of the key cash metrics in your organisation.

-

Include committed spendConsider purchase orders as well as payables so you get the fullest view of your spend horizon and likely cash requirements.

-

Include budgetsIf its too soon to have a transaction brought into the forecast model, include P&L accounts such as payroll and planned large scale investments via their financial budgets.

Speak to one of our experts to see how AccountsIQ can transform your finance function

Get in touch

Customers see success with AccountsIQ

See all case studies-

Ramarketing

ION financial transformation specialist and AccountsIQ help Ramarketing improve reporting and reduce month end close by 40%Find out more -

Tindle Newspaper Group

Tindle Newspaper Group switches from Sage to AccountsIQ for multi-dimensional, streamlined and consolidated reporting.Find out more -

StitcherAds

StitcherAds, with offices in the US, Ireland and the UK switched to AccountsIQ from Quickbooks as they needed multi-user capabilities, …Find out more -

AES International

AES were delighted to find a solution that is intuitive to use and enables them to report their group structure …Find out more

Related Articles

-

Cloud accounting | Feb 2022

Cloud accounting | Feb 2022Cloud accounting vs. traditional accounting

Find out more -

Cloud accounting | Feb 2022

Cloud accounting | Feb 20227 steps to setting up a Cloud accounting system

Find out more -

Cloud accounting | Mar 2021

Cloud accounting | Mar 2021How businesses of all sizes can benefit from cloud accounting

Find out more -

Product News | Feb 2018

Product News | Feb 2018The benefits of cloud accounting software for business

Find out more