What is bank reconciliation and why is it important?

Putting bank reconciliation at the heart of your accounting process can help to make your business more efficient. Knowing why it matters and how to do it effectively can save both time and money.

Here we explain everything you need to know about bank reconciliation, why it matters and the difference it can make for your company.

What is bank reconciliation?

Bank reconciliation is a process of close comparison. It involves looking at your company’s books and your company’s actual bank statement and cross-checking the two records to make sure that they match.

The process involves comparing deposits and withdrawals across the course of a financial period, such as a month, and making sure that each one appears on both lists. If there is no difference between them, then the business is running as it should, because it proves that the money leaving the company account is the same as what has been spent according to your records – the same applies to any money coming into the account.

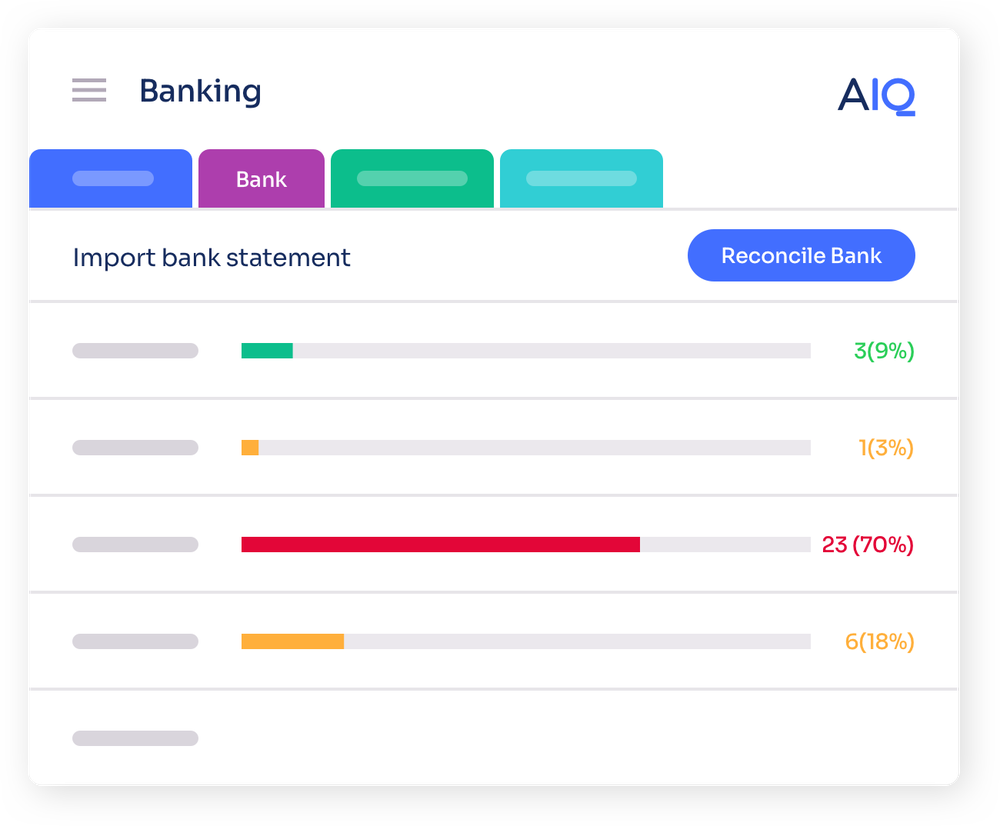

Some companies still choose to perform bank reconciliation in the traditional way, using paper records, but many are finding that automated bank reconciliation software is transformative for their business and helps to eliminate some of the common errors that occur in the bank reconciliation process.

Why is it important to reconcile your financial records?

The main reason to keep on top of bank reconciliation is to compare financial records in small, manageable sections on a regular basis, rather than being left with a long and increasingly confusing list of transactions to go through. Keeping records as accurate as possible through bank reconciliation helps to provide a clear picture of the company’s finances, which is beneficial for everyone in the business. It helps prevent overspending or miscalculation.

However, regular bank reconciliation also allows for the swift identification of fraud – and this is the main reason that many companies make it so central to the responsibilities of their accounting department.

While there are a number of reasons for discrepancies occurring in bank reconciliation, the reason should always be identified because there is always a possibility of fraudulent activity.

The sooner errors are identified, the sooner the problems they create can be kept to a minimum. Bank reconciliation can stop fraud before it gets out of hand, preventing it from doing major damage to your company.

This makes it necessary for some larger companies to carry out bank reconciliation daily, while others may only need to do it at the end of the month.

Why is it important that you reconcile your accounts?

Bank reconciliation brings a number of benefits to your business, and there are several reasons why it should always be included in your accounting process.

Spot fraudulent activity

As mentioned above, when you compare your company’s book with the transactions that your bank officially has on record, you will be able to spot anything that doesn’t match up, however big or small. The reason for any mismatch can often be entirely innocent: you might simply have forgotten to record a transaction, or a cheque may not yet have been cashed. But it is critical that the reason is always established.

It could be that a transaction has been carried out by an unauthorised person who is attempting to steal money from the company’s account. The sooner any missing funds can be spotted, the more quickly they can be recovered and any lasting damage can be mitigated. Regular reconciliation is a crucial security measure.

Validate your data entries

Of course, identifying errors isn’t only about spotting fraud. Common mistakes include double payments, missed payments, lost cheques and simple arithmetic errors – and you don’t want any of these staying on your financial records permanently. Accurate reporting will make it easier to re-examine your financial records in future, should this be necessary for any reason.

Of course, specialised accounting software can help to ensure that everyday mistakes like these are kept to a minimum. Visit our website to learn more about the benefits of investing in digital finance software.

Confirm the accuracy of your financial statements

Not all accounting mistakes happen within your company accounts department – it’s possible for errors to appear on a bank statement too. It may be that a transaction has been duplicated, entered incorrectly or is missing altogether, and regular bank reconciliation will help you to identify any irregularities on either side.

Accurately report on tax

When it comes to filing your company’s tax returns at the end of the financial year, you must have a set of correctly reconciled bank statements and records to ensure accurate submission. Taking a ‘little and often’ approach to bank reconciliation and keeping on top of it will save your accounting department vast amounts of work at the year end – a time which is busy enough anyway.

At AccountsIQ, we can help you to integrate automation into all areas of your accounting, with benefits that extend far beyond just bank reconciliation. Visit our website to learn more about the benefits of an integrated accounting system.